Activities with (positive) asymmetric returns

Improve your life by doing things with convex payoffs

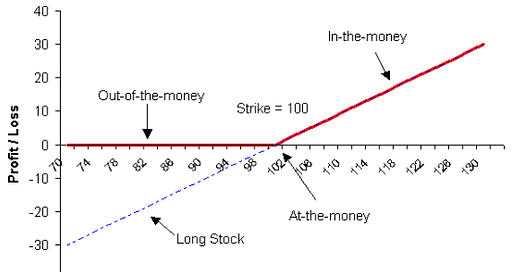

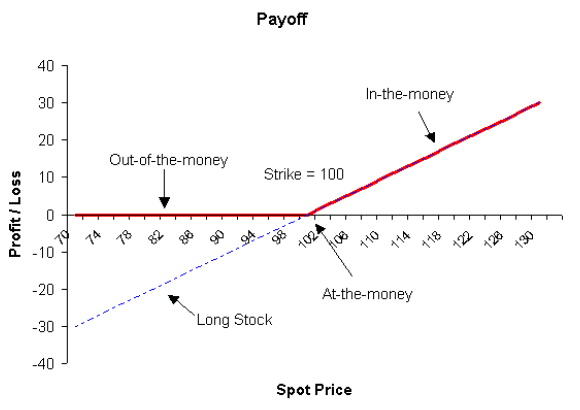

Something has an asymmetric payoff if you stand to gain a lot more than you stand to lose. Stock options, for example, have an asymmetric payoff curve.

In the chart above, the dotted blue line represents the payoff for a stock. It’s linear because a $1 increase in share price means a $1 increase for the stockholder, and a $1 decrease in share price means a $1 decrease for the stockholder.

But the red line—representing the payoff function for a call option on this stock—is not linear. Above $100 (the strike price) the payoff function mirrors that of the underlying stock, but below $100 there’s no more loss.

In other words: you get all the upside but none of the downside.

Unfortunately the market for options is pretty efficient, which means this positive convexity is priced into the option premium. But real-life actions also have payoff curves, and ideally these would also have positive, asymmetric payoffs.

Real-life actions tend to be less-efficiently priced, because

Nobody knows your circumstances better than you do

Humans have all sorts of quirks and biases

Personal decisions are rarely zero sum, but financial markets are

I’ve compiled a non-exhaustive list of actions with (positive) convex payoffs below. Let me know if I missed any!

The List

Giving gifts

Twice in Shoe Dog, Phil Knight sends unsolicited gifts to people’s homes. First, he sends legendary track coach Bill Bowerman a pair of Tiger shoes, which ultimately induces Bowerman to join (what will become) Nike, providing Knight with a powerful business partner.

Then, after visiting his supplier in Japan, he sends a money order to one of the supplier’s employees “for a new bike” to replace the one he lost in WWII. Later, this employee provides Knight with valuable inside information about his employer.

The point is that giving a gift has a small fixed cost (like an option) but the possibility of providing very large returns.

Asking for big things

Asking for stuff has a limited cost (getting rejected) but unlimited gain (getting anything you ask for). The bigger the ask, the better your expected value! Try asking for

Promotions

The downside of asking for promotions is that you annoy your boss. The possible upsides are

You get it immediately

You plant the idea in your boss’s head

You make it seem reasonable that you should be promoted soon

You learn what needs to happen in order to get promoted

So just ask.

Raises

See above. As with investing/interest, small percentage increases in your salary will compound over time, so ask for raises often. (Or switch companies to get one.)

Investments (in your business)

There’s currently a dearth of good startups and a deluge of investor money, so you’d probably be surprised how many people would be willing to invest in your new venture.

But even in less favorable conditions it can never hurt to ask. People with lots of money are always looking for

Good returns

Something interesting to do

Insider status

All of which make them eager to invest. And receiving investment can have huge returns, allowing you to scale your business.

More business (from customers)

Okay sure, asking a prospect “Hey there want to buy my product?” isn’t exactly a nuanced approach to sales. But “asking” in this context could also mean running ads, telling friends, cold emailing people, etc. The upsides here are

You get more customers

You learn why nobody wants to buy your thing

Both of which are immensely valuable. Whereas the “asking” part has virtually zero downside.

Sabbaticals

Obviously it depends on where you work, but in some industries and role the “sabbatical” (i.e. long vacation) is relatively common. It’s expensive to hire your replacement, so if you’re burnt out or considering switching companies, tell your employer you need a break. The worst that happens is they say “no”! And the best case scenario is you get to take a massive paid vacation.

Partnerships (with other people/businesses)

Alright I know I used this example from Shoe Dog already, but Phil Knight partnering with Bill Bowerman was the decision that created Nike. And it happened because Bowerman made the (zero-risk) decision to simply ask Phil Knight if he could join Blue Ribbon. He ended up owning 49% of the company that would become Nike, and (if Shoe Dog is to be believed) got to just hang out at his house and mess around with waffle irons.

Meeting people

Meeting new people can be uncomfortable, but that’s pretty much the only downside. The upside, however, is virtually limitless: you could meet your future life partner, your future business partner, your best friend, your key investor, your biggest client, etc. Sow lots of seeds, and some of them will become sequoias.

Go to meetups

It’s easier to talk to strangers when you all have something to talk about—and what are meetups but groups of people getting together to talk about one thing? Go to a variety of meetups, both to maximize your chances of meeting people but also to learn more stuff!

Join a sports team

Sports seem to breed camaraderie, so joining a sports team can be the fastest way to pick up some new friends. Plus it counts as exercise experimentation, so that’s two birds with one stone.

Volunteer

Putting a bunch of people in a room and saying “okay go be friends now” generally doesn’t work—you need some kind of activity to bond over. And volunteering is a great bonding activity. You’ve more-or-less filtered out all the assholes (who generally don’t volunteer) and volunteers are generally in an open, friend-making mood. Plus you end up learning about something (political campaigns, homeless programs, environmental cleanup) that you probably had no prior experience with (see learning).

Organize something

Benjamin Franklin organized the first American fire department, the first American library, and the first American philosophical society. He was an organizing machine, and it propelled him to great heights. If you find yourself saying “wouldn’t if be nice if there was…” just organize it!

Creative

Writing a blog post

Yeah okay it’s a bit on the nose but blog post-writing has some very asymmetric payoffs. The cost of writing one is fixed and relatively small, but the impact can sometimes be huge. My post on losing \$40K still gets thousands of hits a day, and it took a few hours to write. Sure, many of your posts will be read by zero people, but occasionally thousands of people will read one, which could lead to meeting new people, new business, or exposure to new ideas.

Tweeting

This has the same benefits of writing a blog post, but with far less overhead (and arguably the same payoff profile). I’m just not very good at limiting myself to 280 characters.

Creating a product

Creating a product can also have outsize returns. It’s not always worthwhile (the initial investment could be quite high) but launching the right product or business could change your life.

Learning

The only downside to learning new things is the time you spend doing it—but the upside is enormous.

Reading (the right) books

We can read faster than we can listen (to podcasts) or watch (videos)—so if learning is a convex activity, then reading books will provide the best bang for your buck. And within the book category there are two subcategories that will get you even better payoffs.

Very old books

Old books are good because

They’re Lindy: a book that has survived centuries must have some good (or at least thought-provoking) ideas

They’re unpopular: old books are rarely on bestseller lists, which means the information they provide will be more likely to give you a novel idea (pun intended).

Very specialized books

Specialized books are good because

Deep knowledge in a certain area tends to produce innovations

Again, they’re unpopular: you’ll likely stumble across something that few others have

Experimenting

Experimentation usually involves ratcheting: we can ignore bad results but build on good results. This means that the downside is low (almost zero) but the upside (if you discover something immensely important) is huge.

Below are some examples of things we can all experiment with, but keep an eye out for other opportunities to run experiments.

Diet

Having a good diet makes you more confident, more energetic, and generally better at taking on the world. There is a lot of conflicting diet advice out there, but the costs of self-experimentation are pretty low—so just try some stuff!

In the worst case you’ll get a stomach ache, but in the best case you’ll dramatically improve your health!

Exercise

This is pretty similar to the above section: experimenting with different forms of exercise isn’t hard—but the benefits of finding a type of exercise that works for your body, your schedule, and your preferences can considerably improve your life.

Routine

We are our habits. Life isn’t about one or two momentous decisions, it’s about the little things we do consistently, every day. A corollary is that modifying these habits can lead to massive long-term changes in our lives.

You could argue that the payoff function for habits is in fact symmetric: developing bad habits is bad in the same way that developing good habits is good. But—like a lot of things in this list—careful experimentation can limit the downside (you can stop if things start looking bad) but keep the massive upside. So beware of developing bad habits!

Switching jobs

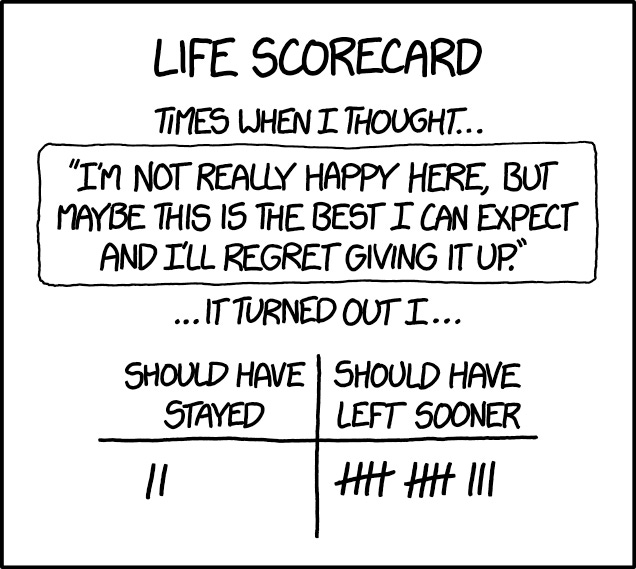

I don’t think I’ve ever talked to somone who regretted switching jobs. Randall Munroe agrees:

Switching roles

Switching roles (i.e. careers) is usually easier if you do it at your current company, and the downsides are often smaller than people think. Generally speaking, companies will let you transition back to your old role, or transition again to another role.

Transitioning roles give you upside in the form of

Professional knowledge about a totally new domain

A better personality/role fit

both of which can have massive positive long-term effects.

Switching companies

This is similar to switching roles, but for people who like their current career path. Switching companies gives you

Insight into a different work culture / business model

A new set of coworkers to meet (see meeting people)

(Usually) A higher salary

Investments

(Disclaimer: none of this is financial advice.)

Not all investments have asymmetric payoffs, and many that do have already been priced accordingly (e.g. options) so investing at random is a bad idea.

Mis-priced investments with large upside and capped downside tend to be ambitious startups, but could also be collectibles (e.g. trading cards) or (dare I say) cryptocurrencies. The downside is capped at zero, but the upside is (virtually) limitless. That’s true for all investments of course, but some investments are more likely to have explosive growth than others.

Things you know about

The market rewards specific knowledge: so if you’re an expert in something, invest in it! Obsessed with Pokemon? Maybe you know something about trends in the Pokemon world that would let you make money investing in Pokemon cards. Obsessed with sailboats? Maybe you know something about the latest sailboat technology that lets you value sailboat companies more accurately.

People you know about

The market cannot possibly price every individual correctly—humans are complicated creatures, and there are a lot of us. This means that some individuals (usually those early in their careers) will be undervalued. Take a look at the people you spend time with and decide if any of them has a brighter future than others might suspect. Then invest in them by…

Investing in them

Is this person starting a business? Great! Invest in it. You’ll get a screaming deal because nobody else knows what a rockstar they are.

Joining them

Is this person starting a business? Great! Join it. You’ll get responsibility and upside that would be impossible once your talented friend is better known.

Hiring them

Are you in a position to hire someone? Then hire your talented friend! They are literally undervalued, so you’ll be getting a Wagyu steak for the price of chuck.

Companies you know about

Large, publicly traded companies are researched to death, but small startups are largely ignored. Among the small businesses started by your friends or family, are any worth more than they’re currently valued? If so, invest in them by

Working for them

Working for a successful company is good for several reasons:

(Sometimes) you get equity which will increase in value

Growing companies promote faster

Growing companies can pay higher salaries

Growing companies are a good learning experience (i.e. they must be doing something right)

Buying equity in them

If you’re an accredited investor you can invest in any company—so just ask! If you’re not, you’ll have to focus on public companies, which you’re less likely to have specific (tradable) knowledge of.